Policy rates hold as Bangladesh eyes inflation ahead of elections, Ramadan

In a widely anticipated decision, Bangladesh Bank has opted to keep its key policy interest rates unchanged, citing cautious optimism over slowing inflation while acknowledging emerging risks tied to the upcoming national elections, the holy month of Ramadan, and structural economic uncertainties.

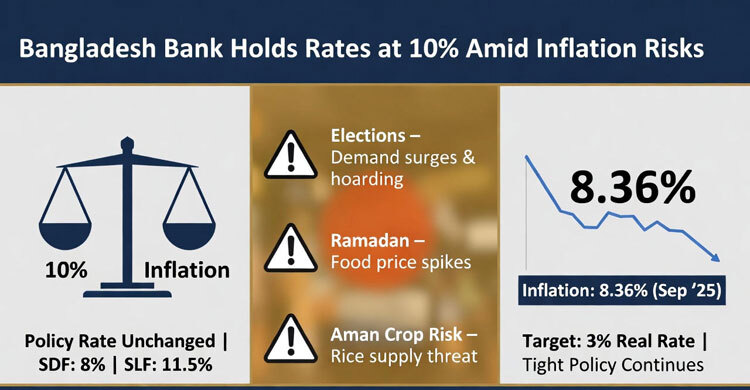

The Monetary Policy Committee (MPC), chaired by Bangladesh Bank Governor Dr Ahsan H Mansur, concluded its latest meeting on Tuesday with a unanimous decision to maintain the policy rate at 10 per cent, the Standing Deposit Facility (SDF) rate at 8 per cent, and the Standing Lending Facility (SLF) rate at 11.5 per cent.

The central bank issued a detailed press release outlining the MPC’s comprehensive assessment of the current economic landscape, highlighting both stabilising trends and looming challenges.

Inflation easing, but risks remain

The committee noted that inflation continues on a gradual downward trajectory, with headline inflation easing to 8.36 per cent in September 2025 – a welcome development after prolonged price pressures in recent years. This decline reflects improved supply chains, stable food prices, and the lingering effects of past monetary tightening.

However, the MPC expressed concern about potential short-term inflationary spikes, warning that several converging factors could disrupt price stability in the coming months. The upcoming national elections are expected to trigger temporary surges in demand and encourage speculative hoarding of essential commodities, particularly in politically sensitive areas.

At the same time, the approaching holy month of Ramadan – historically linked to heightened consumption of food, cooking oil, and other household goods – could further strain supply chains and push prices upward. Compounding these pressures is the risk of weather-induced damage to the Aman paddy crop, which forms the backbone of Bangladesh’s domestic rice supply; any significant yield shortfall could lead to sharp increases in rice prices, with ripple effects across the broader inflation basket.

The proposed new government salary structure, which could feed into broader wage-price dynamics.

Liquidity improves, credit demand still weak

The MPC observed a slight softening in interbank call money and repo rates, indicating improved liquidity conditions in the banking sector. Increased investment in government securities has contributed to some relief in interest rate pressure across financial markets.

Despite this, private sector credit growth remains sluggish. The committee attributed weak loan demand to persistent economic uncertainty surrounding the national elections, which have created hesitation among businesses and investors.

External sector: Imports rise, remittances strong

On the external front, export growth was described as “moderate,” while imports saw an uptick. The MPC clarified that the rise in imports is largely due to the temporary relaxation of LC margin requirements for essential goods, implemented in anticipation of Ramadan.

Meanwhile, remittance inflows continued to perform strongly, providing crucial support to foreign exchange reserves and helping to ease balance-of-payment pressures.

Still, the central bank warned that sustained import growth without corresponding export expansion could widen the trade deficit if not carefully managed.

Monetary stance: Tight policy to continue

Reiterating its commitment to macroeconomic stability, the MPC affirmed that the tight monetary policy will remain in place until the real (inflation-adjusted) policy rate reaches 3 per cent – a benchmark deemed necessary to anchor inflation expectations and foster sustainable growth.