After regime change, sugar prices plunge 40% as Khatunganj syndicate falls

The once-iron grip of Bangladesh’s most notorious sugar cartel has shattered, sending wholesale and retail prices tumbling to their lowest levels in years and delivering rare relief to millions of consumers.

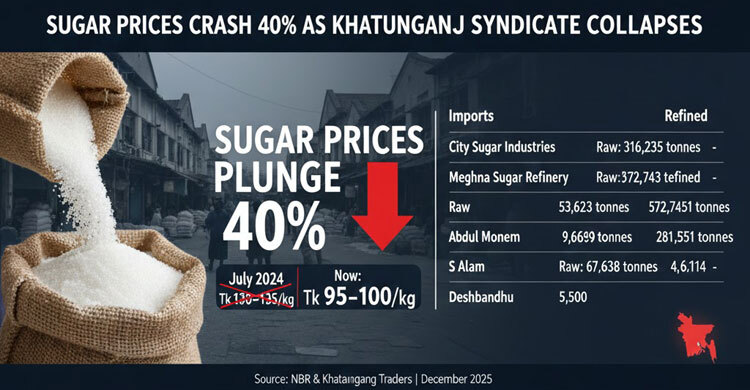

Wholesale sugar in Chattogram’s Khatunganj –the country’s largest food-commodity trading hub – has plunged from Tk 4,440 per maund (37.32 kg) in July 2024 to Tk 3,245 per maund as of 27 November 2025, a drop of Tk 1,195 per maund or roughly Tk 32 per kg.

Retail prices have followed suit, falling from Tk 130-135 per kg to Tk 95-100 per kg, with some shops selling loose sugar as low as Tk 95.

Traders and analysts directly attribute the collapse to the disintegration of the long-dominant sugar syndicate that was largely controlled by a handful of powerful industrial groups closely linked to the previous Awami League government.

“The syndicate centred in Chattogram has completely broken after the fall of the Hasina government,” said Shahjahan Bahadur, a leading DO (delivery order) trader in Khatunganj. “Prices are falling almost every week. If the trend continues, sugar could soon touch Tk 60–70 per kg.”

Alamgir Parvez, owner of RM Enterprise, confirmed: “The market is depressed. In the last month alone the price has dropped over Tk 100 per maund, and compared with a year ago the fall exceeds Tk 1,000.”

End of an era for the ‘Big Five’

Bangladesh imports more than 98 % of its annual requirement of 2.0-2.2 million tonnes of refined sugar. For decades the market was dominated by five private refining giants:

• City Group

• S Alam Refined Sugar Industries

• Meghna Sugar Refinery

• Abdul Monem Sugar Refinery

• Deshbandhu Sugar Mills

Since the July-August 2024 mass uprising that toppled Sheikh Hasina, two of the five have been severely weakened: production at Deshbandhu has halted amid financial and legal troubles, while S Alam Group – once the most influential player – has faced intense scrutiny and asset freezes.

Customs figures from the National Board of Revenue for July to November 2024 reveal a dramatic reshuffle among the major players. City Sugar Industries led raw-sugar imports with 316,235 tonnes, followed by S Alam Refined Sugar at 67,638 tonnes, Meghna Sugar Refinery at 53,623 tonnes, Abdul Monem Sugar Refinery at 9,669 tonnes and the struggling Deshbandhu Sugar Mills with just 5,500 tonnes.

On the refined-sugar side, Meghna Sugar Refinery dominated with 572,743 tonnes, followed by Abdul Monem at 281,551 tonnes and S Alam at 46,114 tonnes, while City and Deshbandhu recorded none. The surge in overall arrivals, combined with the weakened position of two former heavyweights, has flooded the market and driven the ongoing price collapse.

Total sugar imports (raw + refined) in the period reached 1.39 million tonnes, up 450,000 tonnes from the same period last year, further pressuring prices downward.

Consumers finally benefit

SM Nazer Hossain, president of the Consumers Association of Bangladesh (CAB) Chattogram division, welcomed the development: “This proves that when syndicates are dismantled, prices can fall dramatically. The same must now happen with edible oil, rice, pulses and onions. The public has suffered artificial inflation for far too long.”

Retailers across the port city report brisk sales of the cheaper sweetener. Delwar Hossain, owner of Kumkum Store in Kazir Dewri, said: “During the previous regime we were forced to sell at Tk 150. Now packed sugar is Tk 100 and unpacked sugar Tk 95 – and customers are happy.”

Economists caution that while the collapse of the sugar cartel is a clear victory for market competition, sustained low prices will depend on continued regulatory vigilance and diversification of import sources beyond Brazil, which supplies virtually all raw sugar.

For now, however, Bangladesh’s kitchens are enjoying the sweetest outcome of the 2024 political upheaval: sugar at prices not seen in half a decade.