Bangladesh Bank server outage triggers major disruptions across banking sector

A widespread server failure at Bangladesh Bank has severely disrupted the country’s digital financial ecosystem, causing difficulties in internet banking, digital payments and interbank transactions.

The outage, triggered by a power failure on Thursday, December 4, at around 4:00 pm, has had a cascading effect on both consumer services and national payment settlements.

Digital banking grinds to a halt

Customers of various banks reported being unable to log in to internet banking apps, transfer funds or make online bill payments. Many also encountered issues at ATMs and point-of-sale (POS) terminals, particularly those requiring interbank routing.

According to BB officials, the central bank’s core server – responsible for handling large-value payments, automated clearing house operations and overall settlement infrastructure – went offline due to voltage fluctuations that followed the power outage.

“Because of these technical issues, the entire system has collapsed,” said Bangladesh Bank Executive Director and spokesperson Arif Hossain Khan. “All types of interbank transactions are currently closed.”

NPSB and clearing operations suspended

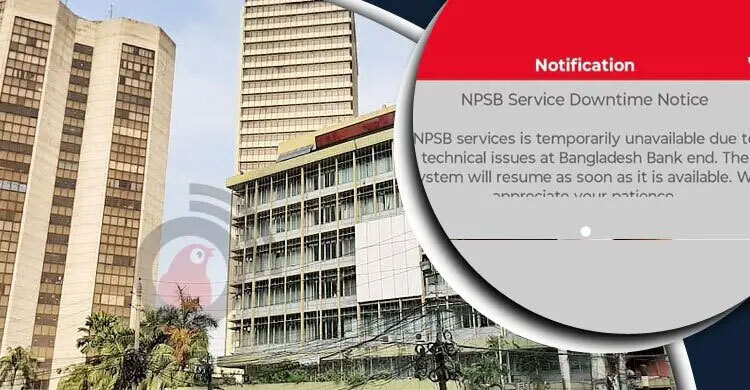

The National Payment Switch Bangladesh (NPSB), a key platform for interbank card transactions, has been shut down temporarily.

The shutdown has disrupted:

ATM withdrawals using cards from other banks

POS transactions at retail outlets

Online purchases requiring interbank authorisation

Wallet-to-bank and bank-to-wallet transfers

In addition, cheque clearing operations under the Bangladesh Automated Clearing House (BACH) have been delayed, affecting salary disbursements, vendor payments and routine corporate transactions.

Local and international settlements – including export-import related payments – have also slowed, raising concerns among businesses reliant on uninterrupted cross-border financial flows.

Banks alert customers, issue apologies

Commercial banks across the country have issued notices informing customers that NPSB services and several digital channels are temporarily unavailable due to “technical problems at Bangladesh Bank’s end”.

Many banks have apologised for the disruption and advised customers to conduct same-bank transactions where possible until services are restored.

Businesses hit as retailers report lost sales

Retailers, e-commerce platforms and digital service providers reported failed payments and cancelled orders.

Supermarkets, fuel stations and pharmacies – where card-based transactions are common – experienced delays and customer frustration. Some businesses temporarily reverted to cash-only transactions as a contingency measure.

E-commerce and on-demand service platforms said hundreds of transactions failed during peak evening hours.

Restoration work underway

Although officials could not give a definitive timeframe for full restoration, BB’s technical team has been working since the afternoon to bring systems back online.

“We are hopeful that services will return to normal very soon,” spokesperson Arif Hossain Khan said.

However, banking specialists noted that the incident exposes vulnerabilities within the country’s payment infrastructure and underscores the need for stronger backup and disaster recovery systems to ensure continuity of national financial operations.

As the disruption continues, both consumers and businesses remain anxious, awaiting the restoration of the backbone of Bangladesh’s digital financial network.