Commodities to face 2026 slump as demand cools, supply surges

After years of turbulence driven by the pandemic, trade shocks, wars and sanctions, global commodity markets may be heading for a sobering correction in 2026, with prices of several key commodities at risk of falling to new lows, predicts the Economist in an analysis.

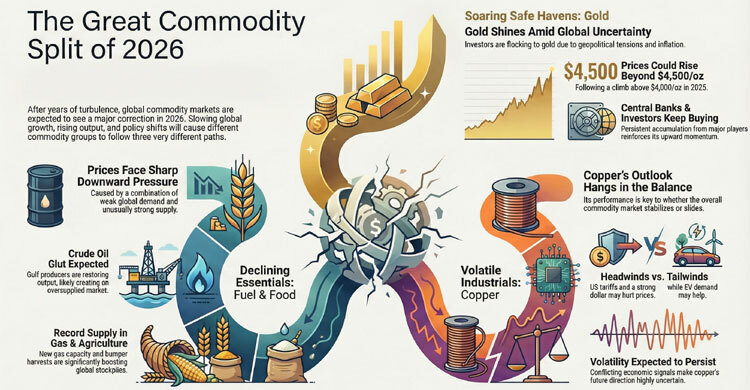

Since 2020, commodities have been buoyed by repeated supply disruptions and speculative demand. But slowing global growth, rising output and shifting policy dynamics suggest the cycle may be turning. Broadly, commodities are expected to fall into three distinct trajectories next year: declining essentials, soaring safe havens, and volatile industrial metals.

Fuel and food under pressure

Energy and agricultural commodities are likely to face the sharpest downward pressure. Demand is expected to remain weak as higher US tariffs weigh on global GDP growth and China’s prolonged economic slowdown curbs consumption. At the same time, supply conditions appear unusually strong.

Natural gas production is at record levels, supported by new capacity coming online in the United States, Qatar and other producers. A warming climate is also reducing the likelihood of demand spikes from harsh winters. In agriculture, bumper harvests of wheat, corn and soybeans in 2025 have significantly lifted global stockpiles, easing price pressures.

Crude oil remains the clearest example of this trend. Unless the United States fully enforces a blockade on Russian oil – seen as unlikely given political sensitivity around fuel prices ahead of midterm elections – global markets are expected to be awash with supply. Gulf producers are already restoring output curtailed in recent years, adding to downward pressure. The key question for markets is whether prices could fall far enough to eventually stimulate fresh demand.

Gold shines as uncertainty persists

In contrast, gold is expected to remain in strong demand. Heightened political uncertainty, geopolitical tensions, trade disruptions and expectations of lower US interest rates have driven investors toward safe-haven assets. After climbing above $4,000 an ounce in 2025, gold prices could rise beyond $4,500 in 2026, supported by persistent inflation in the United States and global instability.

Central banks and retail investors alike are likely to continue accumulating gold, reinforcing its upward momentum. Silver, which benefits both from safe-haven demand and industrial use, is also expected to perform strongly.

Industrial metals hold the balance

The outlook for industrial metals may ultimately determine whether commodities as an asset class stabilise or slide into deflation. Copper, widely regarded as a barometer of global economic health, sits at the centre of this debate.

Copper prices were highly volatile in 2025, surging to record highs after the United States announced steep tariffs on copper imports, before retreating when the measures were clarified to exclude raw materials. Prices later rebounded amid fears the tariffs could be expanded.

That volatility is expected to persist in 2026. Trade barriers could dampen global manufacturing activity, while a stronger US dollar would erode the purchasing power of buyers using other currencies. However, potential interest rate cuts by the Federal Reserve could support demand. Rapid growth in electric vehicle sales may also drive a surge in copper consumption, given its critical role in batteries, wiring and motors. Supply disruptions, project delays and a possible recovery in Chinese manufacturing could further tighten the market.

Investors will be watching closely to see whether copper can offset weakness elsewhere and help global commodities shake off the hangover of recent years.