Mobile phone prices set to fall after 60% duty cut

The government’s decision to slash import duties on mobile phones by 60 per cent is set to bring relief to consumers, with industry insiders predicting a gradual decline in handset prices across segments over the next few months.

Manufacturers and importers have welcomed the move, calling it timely amid rising global costs and recent domestic market tensions.

On Tuesday, January 13, the National Board of Revenue (NBR) issued two separate notifications reducing duties at both the import and production stages of mobile phones, responding to long-standing demands from traders and manufacturers.

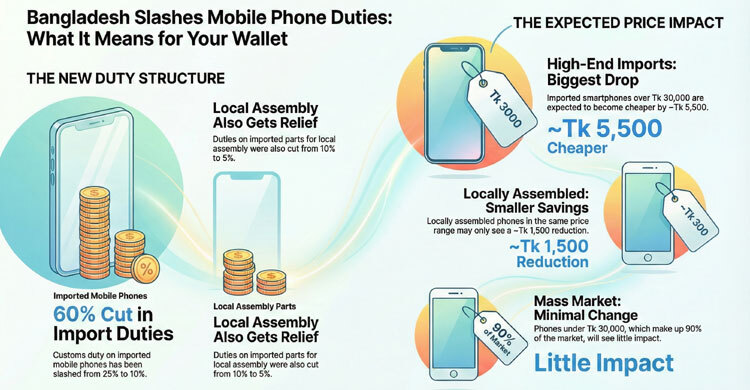

Under the revised structure, customs duty on imported mobile phones has been cut from 25 per cent to 10 per cent, while duties on imported components used by local assembling companies have been reduced from 10 per cent to 5 per cent.

Expected price impact

According to NBR estimates and industry feedback, the impact of the duty reduction will vary by price segment and source of production:

Imported smartphones priced above Tk 30,000 are expected to become cheaper by around Tk 5,500 per unit.

Locally assembled smartphones in the same price range may see a reduction of approximately Tk 1,500 per unit.

For phones priced below Tk 30,000, which dominate the domestic market, the price reduction is likely to be marginal – less than 1 per cent, according to manufacturers.

The NBR said the objective of the move is to keep handset prices within the purchasing power of ordinary consumers and to support wider access to digital services.

Industry reaction: Cautious optimism

Mobile phone manufacturers and importers have largely applauded the decision, though many stress that the benefits will not be immediate.

Mohammad Saifuddin Tipu, General Secretary of the Bangladesh Mobile Phone Industry Owners Association (MIOB), told Jago News that the phones currently on sale were imported or assembled under the previous, higher duty structure.

“The real impact will be felt when new consignments arrive under the revised tariff. We will try to reduce prices as soon as possible – hopefully within a month,” he said, adding that the association expects handset prices to come down to a “more tolerable level.”

Echoing a similar view, Tipu, also Executive Director of Excel Telecom Private Limited, the local manufacturer and distributor of Samsung smartphones – said the duty cut would benefit consumers but could have been deeper.

“We had demanded a more reasonable reduction. NBR has indicated that further adjustments may come in the next budget. Still, if a Tk 30,000 phone comes down by around Tk 5,000, that is a positive step,” he said.

However, he cautioned that global factors continue to exert upward pressure on prices.

“The worldwide shortage of memory chips and the AI-driven surge in demand for memory have pushed up prices globally – in India, Indonesia, Nepal and Bangladesh alike. Prices were already adjusted earlier, and now they will be re-evaluated again.”

Local assembly vs imports

Ziauddin Chowdhury, executive member of MIOB and country manager of Xiaomi Bangladesh, said the company has already started reviewing its pricing structure following the announcement.

“Since import duty has been reduced, we will re-evaluate prices. Only after that will we be able to say exactly how much prices will fall,” he said.

He noted that the duty cut will have a much stronger impact on high-end imported phones than on locally assembled devices.

“For imported phones priced at Tk 30,000, NBR has indicated a reduction of more than Tk 5,500. For locally assembled phones, the impact will be very limited – less than 1 per cent in most cases,” Chowdhury explained.

He also highlighted that around 90 per cent of the roughly 10 million officially sold phones in Bangladesh each year are priced below Tk 30,000, meaning the scope for noticeable price reductions in the mass market remains limited. By contrast, about 2 million phones enter the market unofficially, an issue the government is trying to curb.

NEIR context and market tensions

The duty reduction comes against the backdrop of recent unrest in the mobile phone market following the government’s initiative to roll out the National Equipment Identity Register (NEIR), aimed at discouraging the use of illegally imported handsets.

The move sparked protests by mobile traders, incidents of vandalism at the Bangladesh Telecommunication Regulatory Commission (BTRC), and the arrest of some traders. Amid this tension, industry stakeholders had repeatedly called for tariff relief, arguing that high duties were encouraging illegal imports and inflating prices.

In response, the government assured traders of policy support, culminating in the latest duty cut.

Consumer perspective

Consumer rights groups have welcomed the decision but urged swift action from businesses.

Mohiuddin Ahmed, president of the Bangladesh Mobile Consumers Association, termed the duty cut “very timely” and “a good decision.”

“Consumers will benefit from this, but our experience shows that when taxes increase, prices rise immediately—when taxes fall, prices often come down slowly,” he said. “Importers and manufacturers should reduce prices as quickly as possible so that consumers get the real benefit.”

Government’s position

The NBR said the reduction in duties on both finished phones and assembly components has been designed to strike a balance – lowering consumer prices without exposing local assemblers to unfair competition from imports.

According to the revenue board, the measures will help keep handset prices affordable, expand access to digital services, and support the country’s broader digital transformation goals. The government has also indicated that it will continue such initiatives in the future to ensure mobile phones remain within reach of the general public.

Notably, earlier this year – on January 1 – the Advisory Council had also decided to exempt certain duties on domestically produced phone parts and imported handsets, signalling a broader policy shift amid trader agitation over NEIR implementation.

Outlook

While consumers may need to wait a few weeks – or even months – for the full impact to be reflected at retail level, industry insiders agree that the direction is clear: prices, particularly of higher-end imported smartphones, are heading downward. However, for the vast majority of buyers in the sub-Tk 30,000 segment, expectations should remain modest, as global cost pressures and the structure of local assembly limit the scope for sharp price cuts.