Modest dip, strong momentum: Bangladesh’s export sector finds its footing

Bangladesh's export earnings saw a marginal decline of 0.5 per cent in January 2026, totalling US $4.41 billion compared to $4.43 billion during the same month last year.

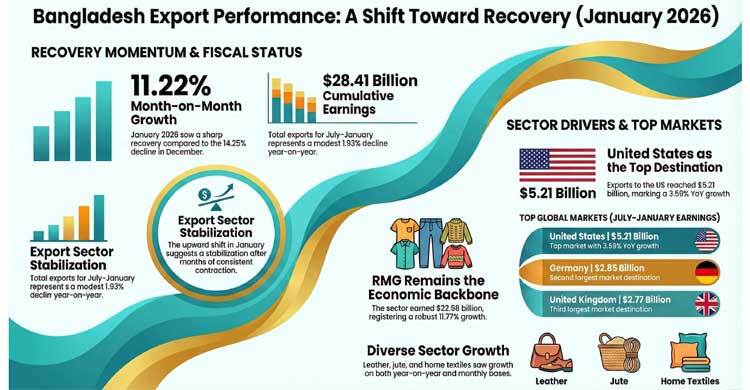

According to the latest data from the Export Promotion Bureau (EPB) released on Monday, the cumulative export earnings for the first seven months (July-January) of the 2025-26 fiscal year fell by 1.93 per cent to $28.41 billion.

Despite the slight year-on-year dip, January demonstrated a significant recovery in trade momentum. Compared to December 2025, which saw a sharp 14.25 per cent decline in earnings, January posted a double-digit month-on-month growth of 11.22 per cent. This upward shift suggests a stabilisation of the export sector following several months of consistent contraction.

The Ready-Made Garments (RMG) sector remains the backbone of the nation's economy, accounting for $22.98 billion of the total July-January earnings. The sector registered a robust 11.77 per cent growth over the previous year, reflecting sustained global demand and enhanced competitiveness despite broader economic headwinds.

Performance in other major sectors was mixed.

Growth Leaders: Leather and leather goods, jute and jute products, home textiles, plastic goods, and light engineering products all registered growth on both a year-on-year and month-on-month basis.

Other Sectors: Agro-processed products and frozen fish showed varied trends, struggling to match the steady growth of the apparel sector.

Key Export Destinations:

The United States maintained its status as the top destination for Bangladeshi products, with exports reaching $ 5.21 billion during the July-January period, marking a 1.64 increase.

United States: Recorded a 3.59 per cent year-on-year growth and 2.24 per cent month-on-month growth.

Europe: Germany and the United Kingdom followed as the second and third largest markets, earning $ 2.85 billion and $ 2.77 billion, respectively.

Other Markets: Spain and the Netherlands also recorded positive turnarounds, reaffirming strong trade ties with the European Union.

While the overall recovery remains modest due to global trade conditions, the double-digit growth between December and January provides a sense of optimism for exporters.

Analysts suggest that if the current momentum in the RMG and leather sectors continues, the fiscal year may conclude with a stronger performance than the initial months indicated.