Economic expansion continues, but momentum eases

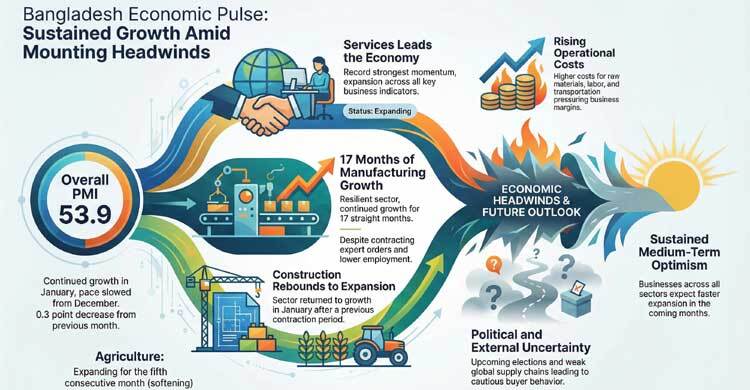

Bangladesh’s overall economic activity continued to expand in January, although the pace of growth moderated, according to the latest Purchasing Managers’ Index (PMI), which showed signs of easing momentum amid rising costs, political uncertainty and cautious business sentiment.

The PMI slipped by 0.3 points to 53.9 in January from December, remaining above the 50-point threshold that indicates expansion, the Metropolitan Chamber of Commerce and Industry (MCCI), Dhaka, and Policy Exchange Bangladesh said in a joint release on Sunday, February 8.

The PMI is prepared with the support of the UK government and technical assistance from the Singapore Institute of Purchasing and Materials Management. It aims to provide timely, forward-looking economic signals for businesses, investors and policymakers.

Despite the slower pace, the report showed that agriculture, manufacturing and services sectors all remained in expansion territory in January, while the construction sector returned to growth after contracting in the previous month.

Agriculture: growth continues, but softens

The agricultural sector expanded for the fifth consecutive month, though the rate of growth slowed slightly. The report noted increases in new business and overall activity, but employment and input cost indices declined, reflecting subdued hiring and easing cost pressures in parts of the sector. Respondents cited the late autumn paddy harvest as one of the factors dampening momentum.

Manufacturing: Sustained expansion with mixed signals

Manufacturing activity expanded for the 17th straight month, underlining resilience in the sector. New orders, factory output, imports, input prices and supplier delivery times all increased during the month. However, new export orders, input purchases, finished goods inventories and employment contracted, pointing to weaker external demand and cautious production planning.

The order backlog index returned to expansion, suggesting some accumulation of pending work, even as exporters remained cautious due to global supply chain weakness and slower overseas demand.

Construction: Back to growth

The construction sector rebounded into expansion territory in January. New business, construction activity and input costs increased, signalling renewed momentum. However, employment and order backlog indices contracted, indicating that firms remain cautious about hiring and future workloads amid uncertainty.

Services: Strongest momentum

The services sector recorded expansion for the 16th consecutive month, with growth momentum strengthening further. All key indicators – new business, business activity, employment, input costs and order backlog – showed expansion, making services the strongest-performing sector in January.

Outlook remains positive, but risks persist

The PMI report offered a generally positive outlook, with businesses expecting faster expansion across all major sectors – agriculture, manufacturing, construction and services – in the coming months.

However, respondents also flagged persistent challenges. Rising raw material, labour, transportation and production costs continue to put pressure on businesses, while sales growth remains weaker than expected. Political uncertainty surrounding the upcoming elections has added to concerns, leading to order suspensions, delayed investment decisions and cautious behaviour from buyers.

Seasonal factors and higher imports have also dampened demand in some sectors. While many businesses expect conditions to improve by March or after the elections, high operating costs and cash flow constraints are currently weighing on business confidence.

Dr M Masrur Riaz, Chairman and CEO of Policy Exchange Bangladesh, said the latest PMI data point to a slowdown in the pace of economic expansion rather than a reversal.

“The weak recovery of global supply chains and cautious order placement have negatively affected manufacturing exports,” he said. “Agriculture has also experienced some moderation due to the delayed autumn paddy harvest.”

However, he added that continued expansion in future business indicators across all sectors reflects sustained optimism about the economy’s medium-term prospects, despite near-term headwinds.