The economic minefield awaiting Tarique Rahman

After 17 years in exile in London, Tarique Rahman returned home on December 25, 2025, stepping into a Bangladesh reshaped by political upheaval and economic strain. His comeback ended years of speculation and culminated in a sweeping electoral victory for the BNP in the 13th Jatiya Sangsad elections, securing more than a two-thirds majority.

Yet the celebrations were short-lived. Just days after his return, his mother, three-time former Prime Minister Khaleda Zia, passed away, marking the end of an era for the BNP and the beginning of a defining test for its new leader.

Now poised to assume office as Prime Minister, Tarique faces a reality far more complex than electoral arithmetic. The economy he is about to inherit is fragile, confidence is thin, and expectations are high.

A slowing economy and shaken confidence

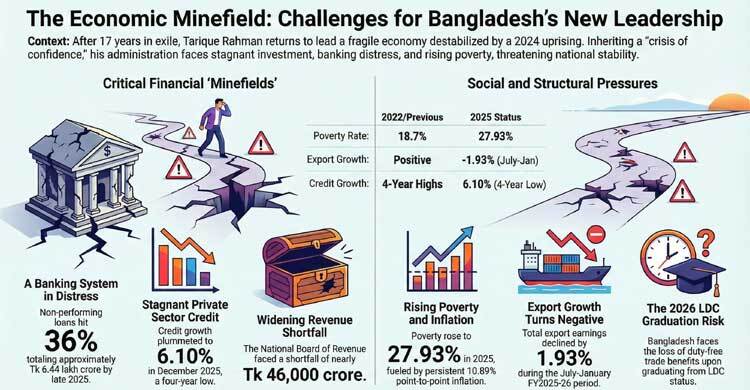

The student-led uprising of 2024 disrupted economic activity across sectors. Investment stalled. Employment generation weakened. Exports, the backbone of the economy, slipped into negative growth.

According to Bangladesh Bank data, private sector credit growth fell to 6.10 per cent in December 2025, the lowest in at least four years.

Net foreign direct investment stood at $1.41 billion during January-September 2025, below expectations. These figures reflect not just a slowdown, but a crisis of confidence.

Economist Professor Dr Mostafizur Rahman of the Center for Policy Dialogue identifies four immediate pressure points: stagnant investment, weak job creation, persistent inflation, and uncertainty in domestic and foreign investment flows.

Restoring investor confidence will require more than political stability. It will demand policy clarity, institutional credibility, and swift administrative reform.

Law and order as an economic variable

Economic recovery cannot take place in an atmosphere of insecurity. Since the 2024 uprising, concerns over law and order have dampened business sentiment.

Industry leaders say a predictable environment is essential for both domestic investors and foreign buyers. Mohammad Hatem, President of the Bangladesh Knitwear Manufacturers and Exporters Association, has called for visible improvements in security, alongside strict action against corruption and extortion.

Without restoring order, economic revival efforts may struggle to gain traction.

Inflation: The immediate pain point

Inflation remains one of the most pressing concerns for ordinary citizens. According to the Bangladesh Bureau of Statistics, point-to-point inflation stood at 10.89 per cent in December, slightly down from 11.38 per cent in November. While the rate has eased marginally, real incomes have not kept pace.

For the incoming government, stabilising prices is not only an economic necessity but also a political imperative. Failure to provide relief could erode public goodwill early in the new administration’s tenure.

Exports under pressure

Exports, which generate the bulk of foreign exchange earnings, have entered a negative growth phase. Data from the Export Promotion Bureau show that export earnings in January 2026 fell 0.5 per cent year-on-year to $4.41 billion. During July-January of FY2025-26, exports declined by 1.93 per cent compared to the same period last year.

The ready-made garment sector accounts for about 83 per cent of total exports. Any prolonged downturn would strain foreign reserves and employment.

Industry leaders are urging the new government to roll out a recovery package immediately after taking office, aimed at restoring competitiveness and reassuring global buyers.

Revenue shortfalls and fiscal pressure

The fiscal space is tightening. The National Board of Revenue had set a collection target of Tk 2,31,205 crore for July-December but managed Tk 1,85,229 crore, leaving a shortfall of nearly Tk 46,000 crore. The annual target stands at Tk 5,54,000 crore.

With a large budget already announced for FY2025-26, financing the next fiscal plan will be challenging. Economists caution against raising indirect taxes, which could burden consumers further. Instead, they recommend widening the tax net, improving compliance through digitalisation, and curbing corruption within the tax administration.

A banking sector in distress

Perhaps the most alarming figure lies within the financial sector. Non-performing loans have reportedly climbed to around 36 per cent of total loans, amounting to approximately Tk 6.44 lakh crore as of September 2025.

A dysfunctional banking system limits credit to productive sectors and undermines overall economic stability. Restoring discipline, strengthening regulatory oversight, and ensuring governance reforms will be critical steps.

Without stabilising banks, broader economic recovery may remain elusive.

Poverty and employment: The social cost

Economic slowdown has had social consequences. A study by the Power and Participation Research Center estimates the poverty rate rose to 27.93 per cent in 2025, up from 18.7 per cent in 2022. Extreme poverty has also increased, according to BBS data.

Job creation must therefore become central to the new administration’s strategy. Experts suggest prioritising labour-intensive sectors, supporting small and medium enterprises, expanding IT skills training, and encouraging entrepreneurship.

Without employment growth, economic frustration could translate into social unrest.

LDC graduation: Opportunity and risk

Bangladesh is set to graduate from Least Developed Country status in 2026. While this marks a milestone, it also means the eventual loss of certain duty-free trade benefits.

To cushion the impact, the government may need to accelerate trade negotiations, pursue preferential trade agreements, and diversify export products beyond garments. Productivity gains and technological upgrades will also be essential to maintain competitiveness.

Handled strategically, the transition could become an opportunity rather than a setback.

Foreign policy and economic diplomacy

Economic recovery is tied to diplomatic balance. Relations with key partners, particularly India and the United States, require careful recalibration. Former ambassador Munshi Faiz Ahmed argues for pragmatic diplomacy, active multilateral engagement, and a review of recent agreements to safeguard national interests.

Reactivating ties with major economies, including China, Japan, Russia, and Western partners, will be important to attract investment and secure market access.

The first budget test

Soon after taking office, the new government will have to prepare the 2026-27 budget. Economist Dr Zahid Hossain notes that aligning fiscal policy with public expectations while managing limited resources will be a delicate exercise.

The first budget will signal whether the administration prioritises short-term relief, long-term structural reform, or a balance of both.

A defining moment

Tarique Rahman’s political return has already reshaped the country’s power structure. The next chapter will determine whether that return also marks an economic turnaround.

The challenges are formidable: inflation, weak investment, export slowdown, banking fragility, revenue deficits, and rising poverty. But history often tests leaders not in moments of triumph, but in moments of strain.

For Bangladesh’s next Prime Minister, the real mandate begins not with a parliamentary majority, but with restoring trust in the economy.