Salman F Rahman ‘unwanted’ for life in capital market, faces Tk 100cr fine

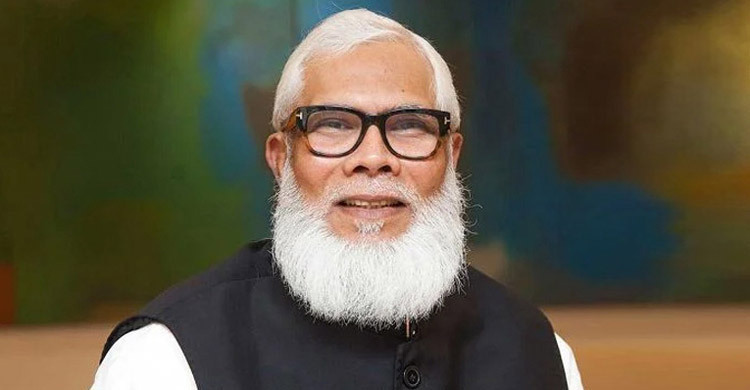

The Bangladesh Securities and Exchange Commission (BSEC) has imposed one of the most severe penalties in the country’s capital market history, fining Salman F Rahman Tk 100 crore and declaring him permanently disqualified from participating in the capital market.

Salman, a former adviser to ousted Prime Minister Sheikh Hasina and former chairman of IFIC Bank, was identified as a key player in capital market manipulation during the fallen regime.

His son, Sayan Fazlur Rahman, former Vice-Chairman of IFIC Bank, has also been fined Tk 50 crore and declared permanently barred from capital market activities.

The landmark decision was taken during a BSEC commission meeting on Wednesday, July 30, chaired by BSEC Chairman Khandaker Rashed Maqsood.

The penalties stem from serious irregularities related to the ‘IFIC Guaranteed Sripur Township Green Zero Coupon Bond’, a controversial financial instrument that misled investors and violated capital market regulations.

IFIC Amar Bond misled investors

The bond, officially titled “IFIC Guaranteed Sripur Township Green Zero Coupon Bond”, had a face value of Tk 1,500 crore and an issue value of Tk 1,000 crore. It was approved by BSEC in its 871st meeting on June 4, 2023, with a consent letter issued on July 12, 2023.

The issuer, Sripur Township Limited, was incorporated just months earlier, on March 2, 2023, and applied for the bond issuance on April 11, 2023, immediately after incorporation. The company had an authorised capital of Tk 500 crore, with a paid-up capital of Tk 335 crore.

Alarmingly, Tk 248 crore in cash was withdrawn from the company’s account within just four days of the bond issuance, purportedly for land acquisition and development – raising serious red flags about misuse of investor funds.

Although IFIC Bank PLC was only the guarantor of the bond, IFIC Investment Limited served as advisor and arranger, Sandhani Life Insurance Limited as trustee, Emerging Credit Rating Limited (ECRL) as credit rating agency, and MJ Amedin & Co Chartered Accountants as auditors.

Critically, the bond was marketed under the name “IFIC Amar Bond” in advertisements, creating a false impression that IFIC Bank itself had issued the bond – a move that BSEC found to be deceptive and misleading to the public.

BSEC’s comprehensive penalties

Following a detailed investigation by the Capital Market Investigation and Inquiry Committee, BSEC has taken sweeping enforcement actions:

- Salman F Rahman: Fined Tk 100 crore and permanently debarred from the capital market.

- Sayan Fazlur Rahman: Fined Tk 50 crore and permanently debarred.

- Imran Ahmed, former CEO of IFIC Investment: Banned for 5 years from all capital market activities.

- Shah Alam Sarwar, former Managing Director of IFIC Bank: Subject to enforcement action.

- IFIC Bank: Issued a formal warning.

- Former IFIC Bank Directors: ARM Nazmus Shakib, Md Golam Mostafa, Md Zafar Iqbal, Kamrun Nahar Ahmed, and Shudhangshu Shekhar Biswas (Independent Director), – all have been warned for their roles.

- Emerging Credit Rating Limited (ECRL): Fined Tk 10 lakh for failure in due diligence.

- Former BSEC Leadership: Professor Shibli Rubaiyat-ul-Islam, former BSEC Chairman: Permanently debarred; and Dr. Sheikh Shamsuddin Ahmed, former Commissioner: Debarred for 5 years.

The BSEC has also ordered further investigation by an Additional Commission of Inquiry to identify and take action against all other individuals and entities involved in the violations.

A message to the market

BSEC Spokesperson and Director Md Abul Kalam emphasised that the decision sends a strong message against market manipulation and investor deception: “This was not just a regulatory violation, it was a breach of public trust. The capital market must be transparent, fair, and accountable. We will not tolerate misuse of institutional names to mislead ordinary citizens.”