Default loans reach Tk 6.44 lakh crore

Bangladesh’s banking sector has plunged into its deepest crisis in decades as default loans soared to an unprecedented Tk 6.44 lakh crore by the end of September 2025, according to data released on Wednesday by Bangladesh Bank.

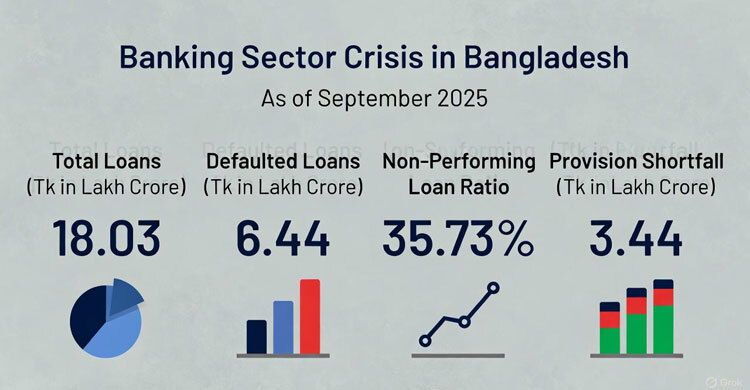

The figure represents a staggering 35.73% of the sector’s total outstanding loans of Tk 18.03 lakh crore – the highest non-performing loan (NPL) ratio since records began in 2000.

In just one year, defaulted loans have more than doubled, rising from Tk 2.85 lakh crore in September 2024 to Tk 6.44 lakh crore this year – an increase of Tk 3.61 lakh crore.

Over the first nine months of 2025 alone, bad loans jumped by nearly Tk 3 lakh crore from Tk 3.45 lakh crore recorded in December 2024.

The sharpest surge occurred in the past six months, with default loans climbing Tk 2.24 lakh crore from Tk 4.20 lakh crore in March 2025 to Tk 6.44 lakh crore by September.

Industry insiders attribute the explosion partly to the tightening of loan-classification rules introduced in March 2025 to align with international best practice and meet conditions attached to the International Monetary Fund’s $4.7 billion loan package.

Under the reinstated 2012 policy, a loan is now classified as defaulted after just three months of non-payment, compared with nine months previously.

However, experts and bankers say the primary driver has been the exposure of widespread loan scams and irregularities that occurred during the 16-year Awami League government, which collapsed following the student-led uprising last year.

The crisis has also triggered a massive provision shortfall of Tk 3.44 lakh crore, leaving many banks critically under-capitalised.

The net NPL ratio climbed to 26.4% by September, up from June’s figure, with net non-performing loans standing at Tk 4.15 lakh crore.

Regulators have signalled tougher oversight and restructuring measures in the coming months, while calls grow for swift action to recover wilfully defaulted loans and hold those responsible accountable.

The dramatic deterioration has renewed concerns over Bangladesh’s financial governance at a time when the interim government is seeking to restore investor confidence and stabilise the economy.